The jury’s out on whether Dodd-Frank will save Capitalism

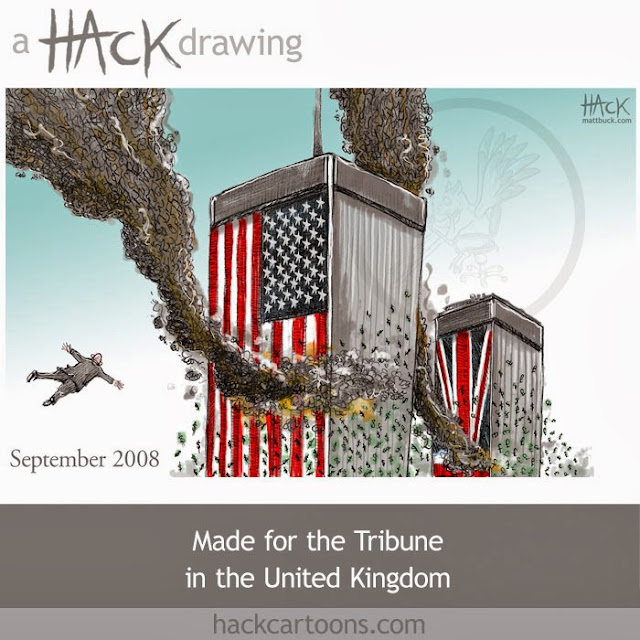

It’s been five years since the onset of the financial crisis — the rescue of Bear Stearns in March 2008 — and we still don’t know whether the financial system is safe. In a recent speech, Daniel Tarullo, the Federal Reserve’s point man on regulation, contended that substantial, though incomplete, progress has been made. As an example, he cited the doubling of equity capital for the 18 largest bank holding companies from $393 billion in late 2008 to $792 billion at the end of 2012. Equity capital is shareholders’ money; it acts as a buffer against losses. Interestingly, JPMorgan Chase’s well-publicized $6 billion loss by the trader nicknamed the “London Whale” confirms the point. Despite the loss’s size, it never threatened a panic or overall financial stability.

Then there’s Dodd-Frank, the 848-page law named after its now retired champions, Sen. Christopher Dodd and Rep. Barney Frank, who as chairmen of the relevant congressional committees presided over its creation. Although hugely complicated, the law embodied a simple theory of the crisis. Banks and other financial institutions brought it on through bad judgments and ethically questionable practices. This justifies tougher rules and regulators to avoid future lapses. With hindsight, Dodd-Frank might seem to have been inevitable.

Not so.

In an important new book, “Act of Congress,” Robert Kaiser of The Post shows that the legislation’s prospects were touch-and-go for long stretches before its approval in 2010. One reason was that financial legislation competed for attention with President Obama’s health-care proposal, and financial overhaul had to wait. “The American political culture isn’t good at multitasking,” Kaiser writes. “We tend to let the most controversial or dramatic topic of the moment take up all the room for discussion and debate.”

But the larger causes were complexity and contentiousness. Yes, the status quo needed changing, but there were sharp disagreements over how. Many interest groups vied to shape the outcome — or protect themselves from it. Democrats demanded a new agency focused on consumers (ultimately, the Consumer Financial Protection Bureau); Republicans feared duplication and favored leaving consumer regulation with the Federal Reserve. Despite intensive lobbying, Kaiser reports, big commercial banks and investment banks were less influential than the 7,000 or so smaller community banksand close to 18,000 auto dealers. Wall Street was blamed for the crisis; small bankers and auto dealers had deep local ties in congressional districts.

Virtually the only bipartisan agreement was: no more bailouts. (During the crisis, big banks and financial institutions borrowed from the Fed and received funds from the Troubled Asset Relief Program.) Otherwise, Dodd-Frank didn’t attract much Republican support. The final legislation includes a new “Financial Stability Oversight Council” — chaired by the Treasury secretary — to spot dangerous trends, plus restrictions on banks’ “proprietary trading” (buying and selling securities for their own accounts, not clients’) and on the trading of “derivatives” (futures contracts, options and the like). Other provisions try to end the “too big to fail” doctrine that justified propping up weak financial institutions.

As Kaiser notes, Frank views the law as the third historic government intervention to save capitalism from its excesses. The first occurred in the early 20th century: Theodore Roosevelt deployed anti-trust laws to limit the power of massive industrial enterprises; under Woodrow Wilson, Congress created the Federal Reserve in 1913 to improve financial stability. Franklin Roosevelt orchestrated the second great intervention with the establishment of the Securities and Exchange Commission to police the stock market and the Federal Deposit Insurance Corp. to prevent bank runs.

At least two problems might derail this rendezvous with history.

First, Dodd-Frank may have gone overboard. To be sure, banks’ stupid loans and risky investments nearly caused the entire financial system to crash. But the resulting financial crisis and Great Recession had already caused banks to tighten lending standards. Dodd-Frank’s outpouring of rules and restrictions — coupled with regulators’ more stringent attitudes — may compound caution. Stodgy banks would then impede a more dynamic economy, faster growth and lower unemployment.

A second possibility is that Dodd-Frank perversely worsens financial instability in another crisis. In 2008-09, the Fed relied heavily on section 13(3) of the Federal Reserve Act to make loans to stem the panic. In effect, section 13(3) expanded the Fed’s ability to be a “lender of last resort.” The Fed received broad lending authority and discretion in determining the worth of collateral. But reflecting public outrage over bailouts, Dodd-Frank curbed these powers. If the Fed can’t respond quickly to a crisis, panic may ensue and feed on itself. The last crisis may have stemmed less from lax regulation than from prolonged prosperity, which made both bankers and regulators complacent. If “good times” were to blame, future crises may be unavoidable.

Will Dodd-Frank save capitalism or suffocate it? It may be years before we know.

42

Comments